Fintech Payroll Platform

Webapp – UX/UI 2022

Role

UX/UI Designer

Tools

Figma

XD

Industry

Accountability

Nomicol is a platform that helps small businesses digitalize their payroll processes. It allows them to manage and store their employee information and update the payroll status, saving time and preventing getting fined due to errors in payroll calculations.

92% of companies in Colombia have less than 20 employees and don’t have accounting and HR teams within their workforce. Most of these companies still manage payroll manually. This increases the risk of error and therefore of getting fined by government organizations.

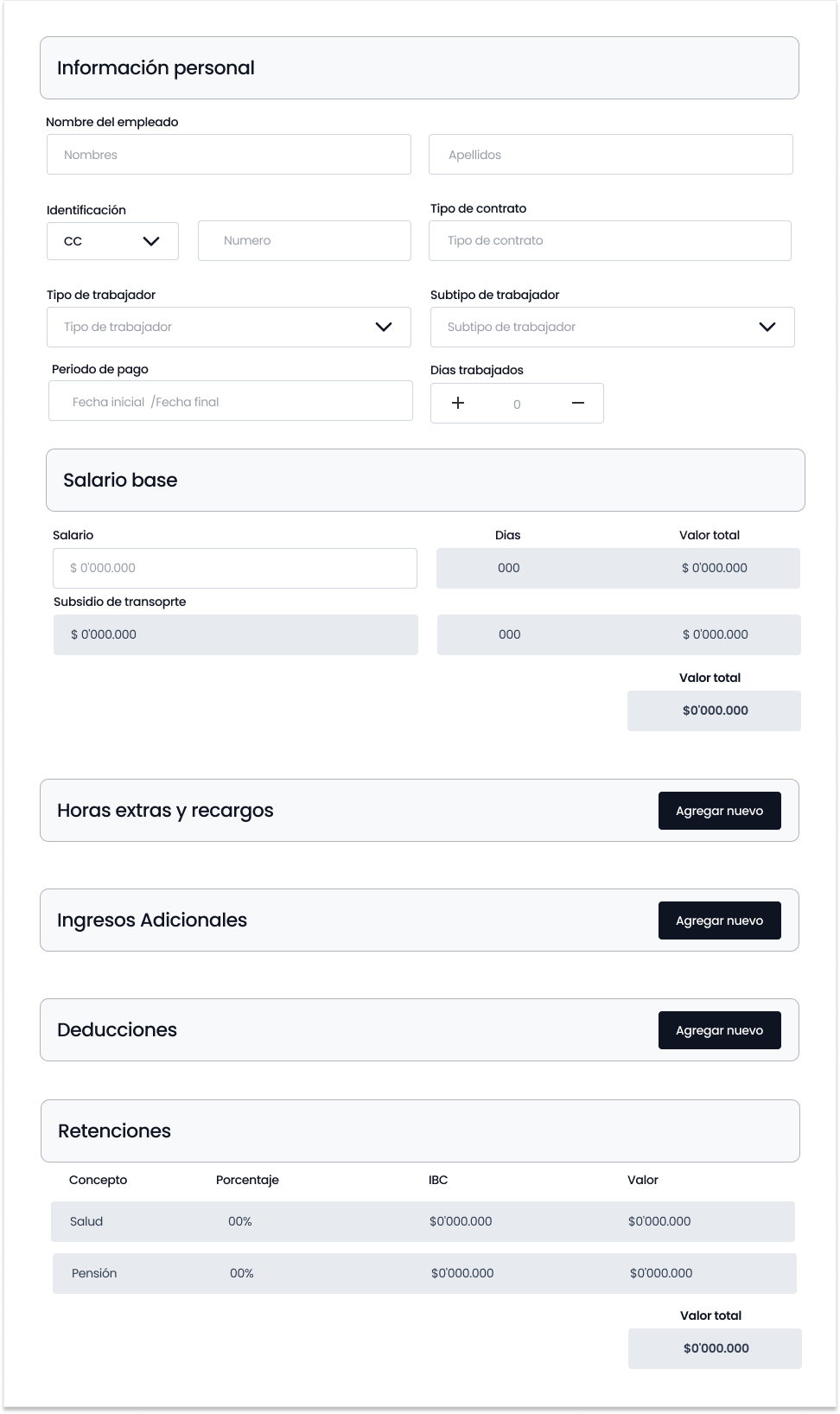

- Register all employee information.

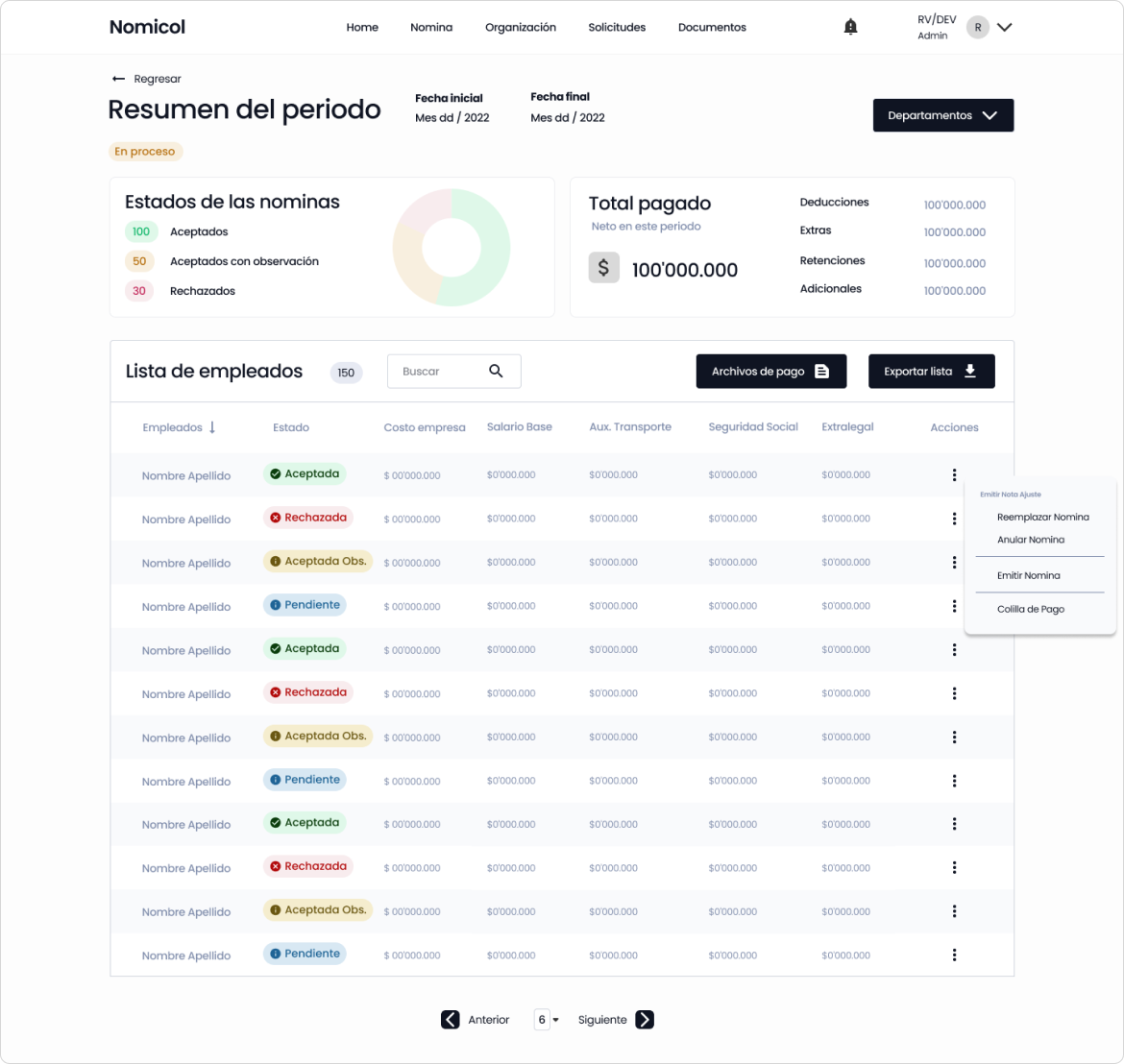

- Have a clear history of all payment periods and payroll reports.

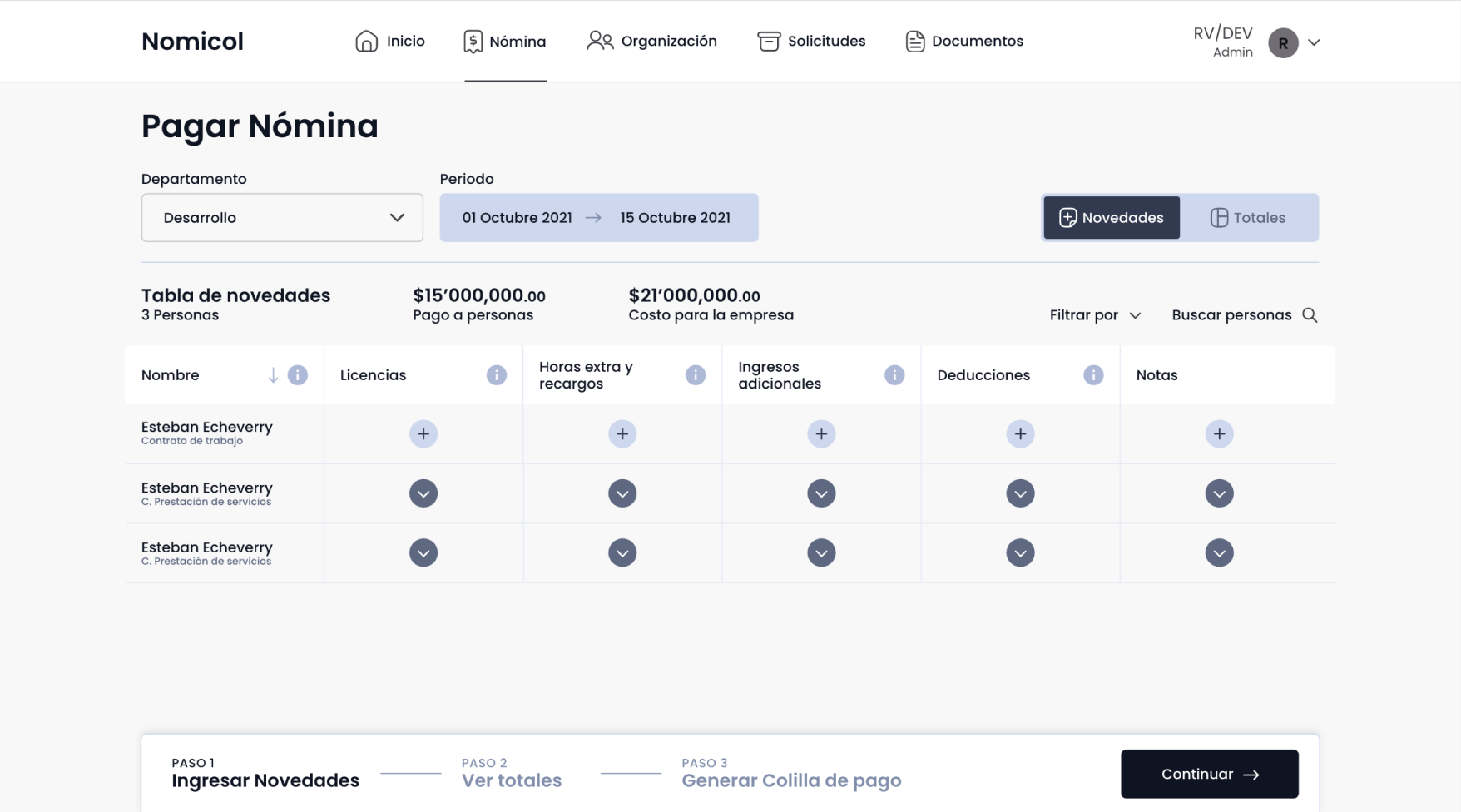

- Update the payroll status by entering overtime pay, deductions, and other additional payments each month.

- See the status of their next payment in real time.

View their payroll history.

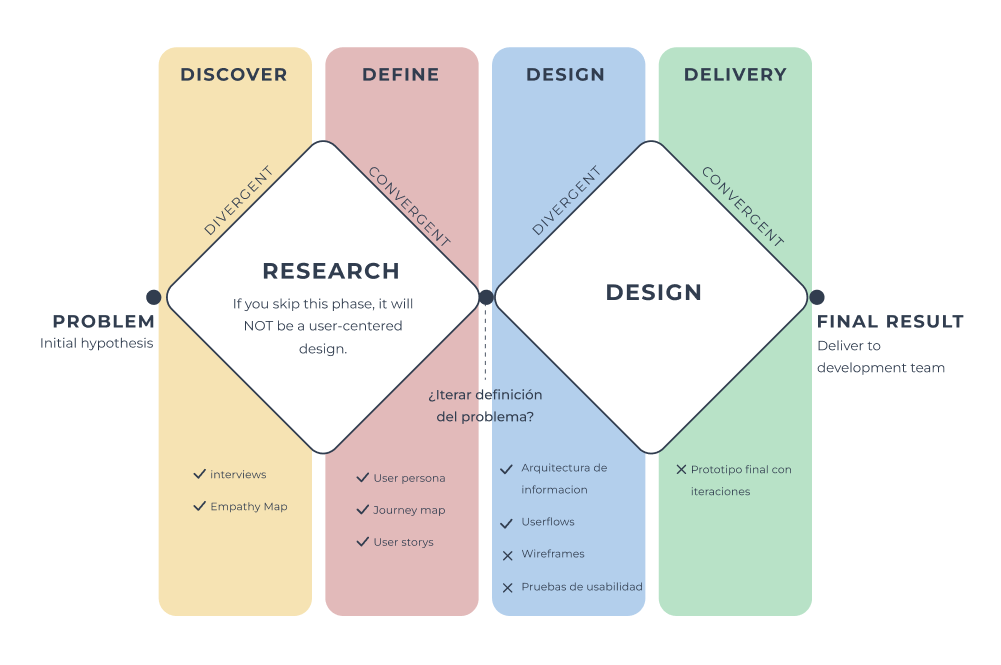

Design Thinking

How might We

How can we help small businesses make their payroll processes more efficient and prevent getting fined by reducing risk of error.

Goals of the project

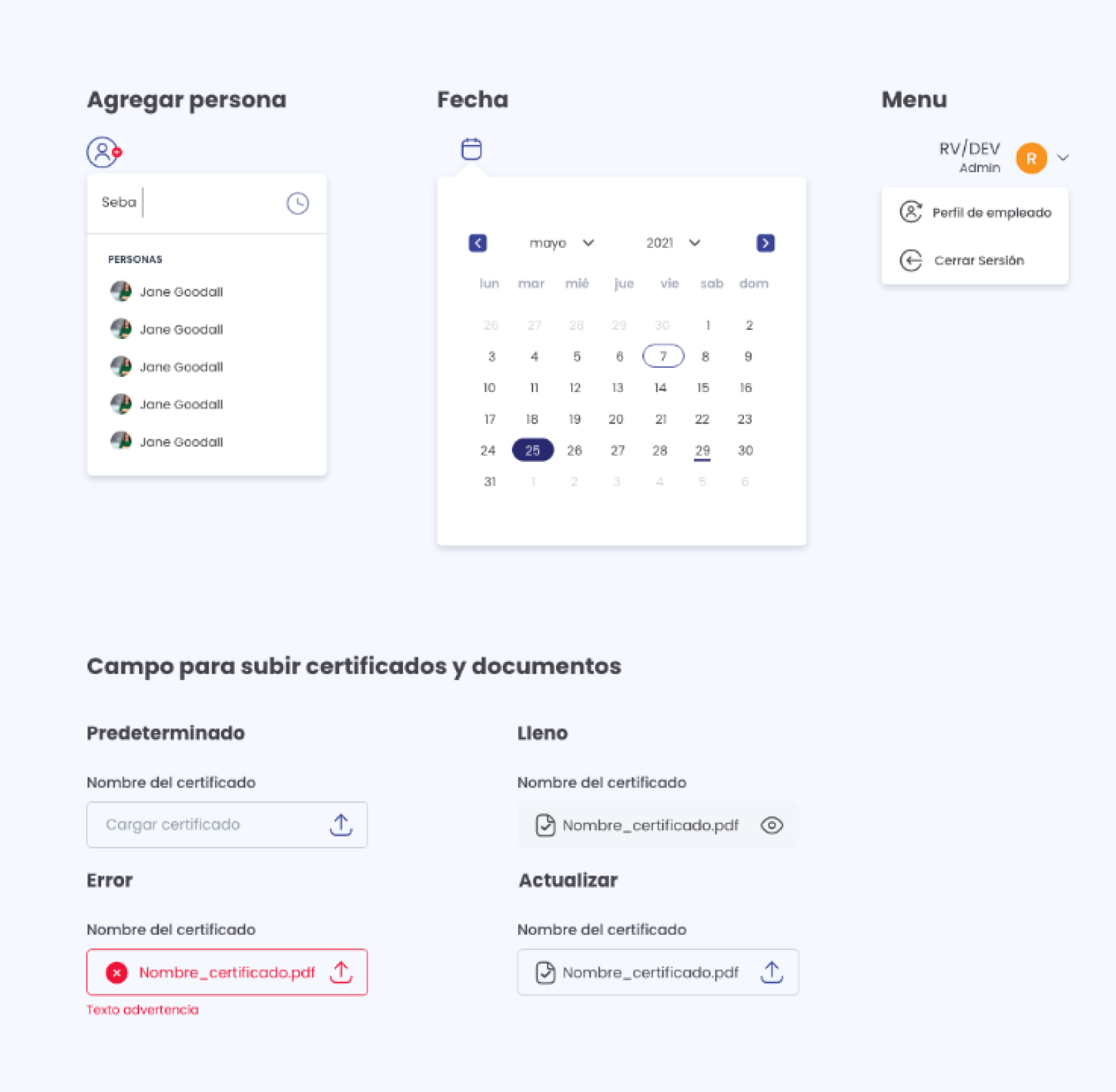

- Allow companies to easily register on the platform and manage their employee information.

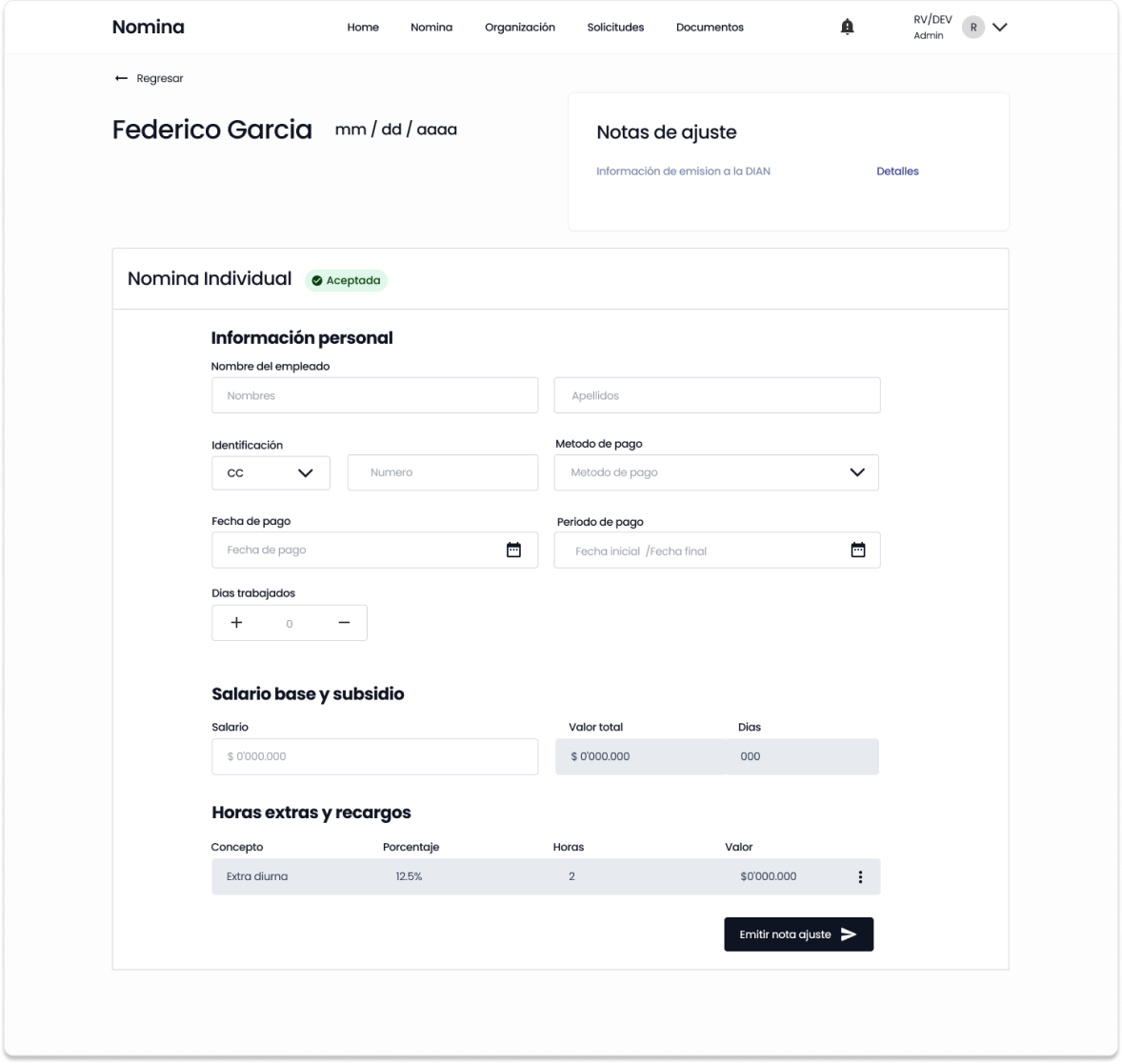

- Allow companies to enter payroll updates such as overtime pay, deductions, vacations, and taxes.

- Generate payroll reports.

- Allow employees to see the status of their next payment in real time.

- Allow all users to visualize payroll history.

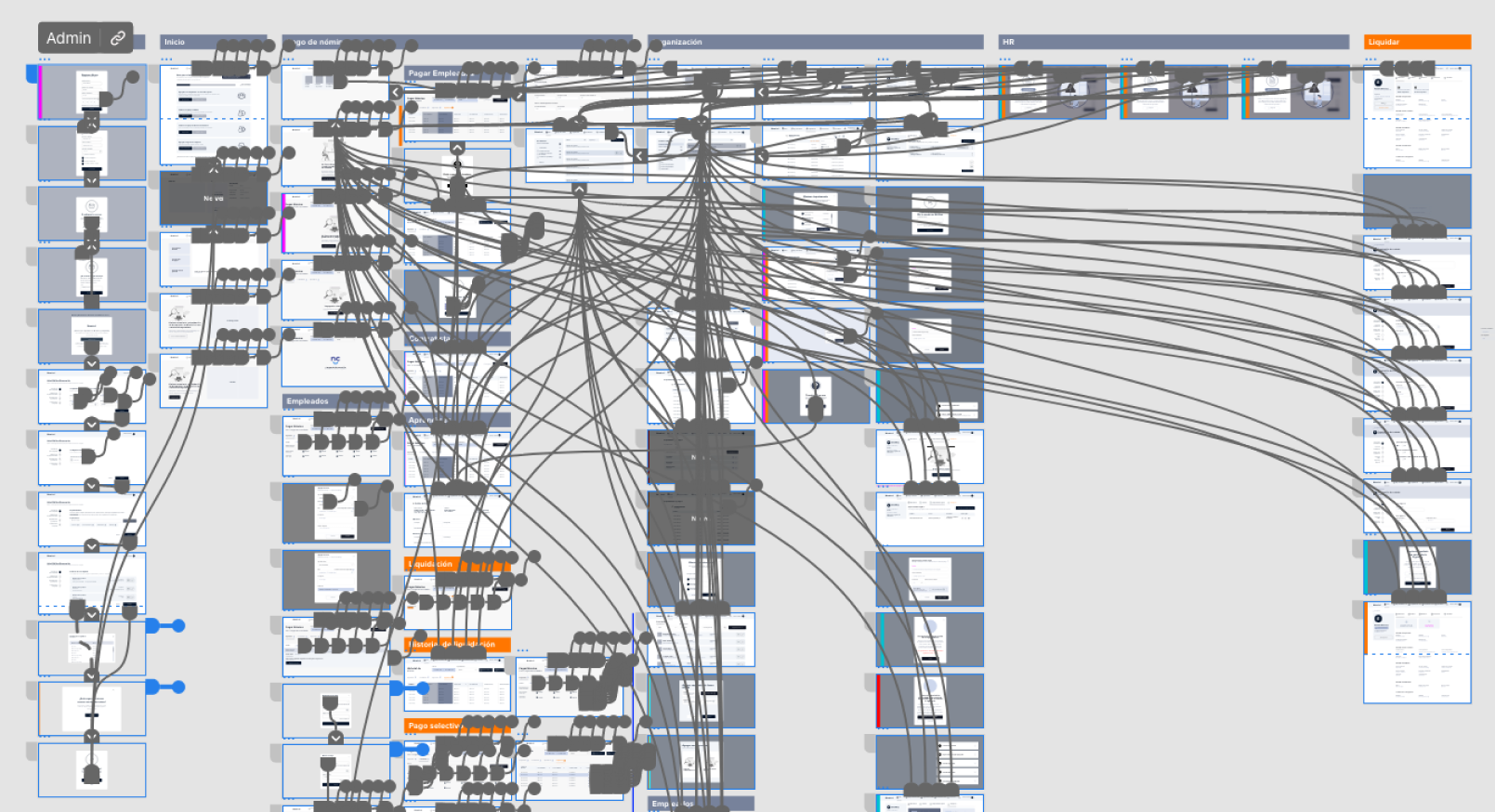

Userflows and architecture of information

20 Userflow

3 Architecture of information

Wireframes

Iteration 1 — Structure

Create dashboards to reduce time-to-information

Move from tables → smart, structured information

Introduce step-by-step workflows

Add centralized alerts instead of hidden errors

Iteration 2 — Validation

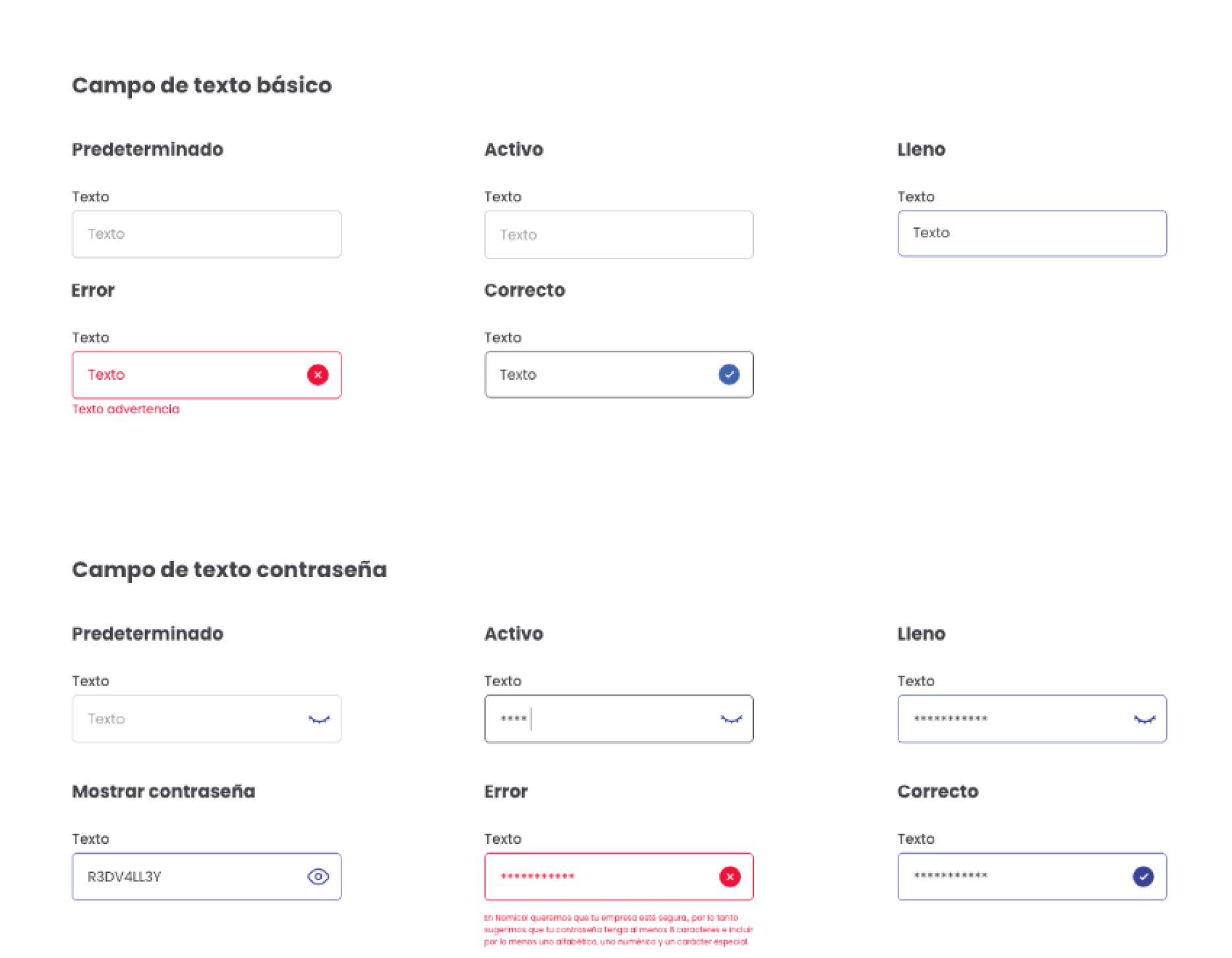

Inline error flagging

Rule explanations

Grouped exceptions

Simpler approval flow

Iteration 3 — Accessibility + Density

WCAG contrast

High-density table optimizations

Sticky headers

Keyboard navigation

These iterations helped transition from a static UI to a dynamic financial decision platform.

Final Designs (Key UX Solutions)

A. Unified Payroll Dashboard

Warnings and critical blockers

Upcoming tasks

Quick access to employee issues

Real-time cost and hours insights

Impact:

Teams reduced prep time by 60%.

B. Smart Error-Flagging System

Detects missing hours, invalid deductions, outdated documents, wrong bank info, etc.

Color-coded flags (Critical / Medium / Info)

Inline explanations and fixes

Impact:

Error-related incidents dropped by 80%.

Qualitative Impact

Finance teams feel “in control“

HR stopped depending on spreadsheets

Managers reported “zero confusion” in approvals

Employees gained trust because pay transparency improved

This redesign transformed payroll from a stressful manual workflow into a controlled, automated, compliance-ready system.

What I learned

Designing for accuracy requires clarity, not complexity

Automation must be transparent to earn user trust

Payroll UX is deeply tied to compliance and legal risk

Dense financial tables can still be user-friendly with correct hierarchy

Fintech design is about reducing cognitive load during critical tasks